Australia could tax Google, Facebook and other tech giants with a digital services tax - but don't hold your breath

The Conversation

27 May 2025, 20:23 GMT+10

Tech giants like Google, Facebook and Netflix make billions of dollars from Australian users every year. But most of those profits are not taxed here.

To address this tax gap, some countries have introduced a new kind of tax called the digital services tax, or DST. It applies to revenue earned from users in a country, even if the company has no physical operations there. Some European Union member countries, the UK and Canada have all introduced such a tax.

In Australia, it is estimated the five largest tech giants recorded A$15 billion in revenue in Australia last year, but combined they paid only $254 million in tax.

Australia has never contemplated imposing a similar tax. New Zealand tried but backed down last week after the United States threatened to impose higher tariffs on New Zealand goods.

So what's holding Australia back?

To understand why Australia thinks its hands are tied on the taxation of the multinational tech giants, we need to step back in time.

About 100 years ago, Australia and other developed nations decided to tax residents on all their income earned worldwide, while non-residents were taxed only on income earned locally.

After the second world war, Australia entered into tax treaties so foreign companies selling to Australian customers would no longer be taxed here. Instead, those companies' home countries would tax all their profits.

As the world moved to digital products this century, it became easy for giant multinational enterprises offering advertising on social media (such as Facebook and Instagram), advertising on search platforms (Google), and streaming services (Netflix) to provide those services from abroad. Little or no activity is conducted through local branches.

But countries where the sales are made have increasingly questioned the wisdom of having forfeited their taxing rights over income by foreign providers.

The obvious solution would have been to renegotiate the treaties. This would restore the right of countries like Australia to tax foreign companies' profits made from local customers or users.

However, treaty renegotiation is slow and complex. So several European countries, beginning with France in 2019, came up with a short-cut solution.

They introduced a discrete new tax on sales of digital services, called digital services taxes (DSTs). While the specific design varies by country, most DSTs apply a low tax rate, typically between 3% and 5%, on revenue rather than profits. They target large digital platforms that earn money from users within the taxing country, regardless of the company's location.

Because DSTs are levied on revenue and are structured as separate from income tax, governments argued they could be introduced without breaching income tax treaties.

The new taxes quickly became popular and spread widely. In Australia, the Greens have called for a DST, but both major parties have remained steadfast in their objection to a new tax. This is due to the concern that the US may impose retaliatory tariffs on Australian goods.

Australians are enthusiastic consumers of digital products. Depending on which companies are included in the calculation, the annual revenues vary between $15 billion and $26 billion a year, but only a fraction of that is taxed here.

At a time when the federal budget is forecasting deficits for the foreseeable future, Australia is foregoing potentially millions in lost revenue from these digital giants.

While Australia has avoided a DST as a solution to the income tax loss, it has been willing to regulate and tax foreign digital companies in other ways. Australia collects 10% goods and services tax, or GST, on digital services provided to Australian companies, including streaming platforms and app subscriptions.

This helps ensure foreign providers are taxed similarly to domestic ones when it comes to the GST.

Australia has also imposed non-tax obligations on digital giants such as the requirement that digital platforms pay Australian media outlets for using their news content.

Read more: Australia's 'coercive' news media rules are the latest targets of US trade ire

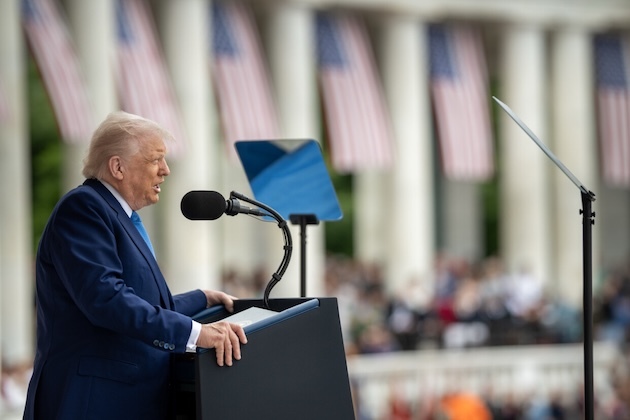

In February, the Trump administration described DSTs as tools used by foreign governments to "plunder American companies" and warned retaliatory tariffs would be imposed in response.

The accompanying White House fact sheet singled out Australia and Canada, arguing the US digital economy dwarfs those countries' entire economies. It suggested any attempt to tax US tech companies would not go unanswered.

Six weeks later, the US imposed a 10% tariff on most Australian exports to the US and a 25% tariff on steel and aluminium exports.

The US sees its penal tariff plans as a useful negotiating tool to pressure trading partners into retreat on a broad range of peripheral complaints, including the digital services tax.

To date, only two countries have retreated: New Zealand and India. Other countries are standing firm.

In Australia, the Greens have called for the adoption of a DST, but the current and previous governments remain firm in their opposition. There is concern about antagonising the US at a delicate time when our broader trade relations are under scrutiny.

For the foreseeable future, the digital giants will continue to earn billions from Australian users. Most of those profits will remain beyond the reach of Australian tax law.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Australian Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Australian Herald.

More InformationInternational

SectionCanadians turn out in thousands to pay tribute to Israel

TORONTO, Canada - Tens of thousands of people from across Canada have marched in support of Israel in a massive turnout in Toronto....

Foreign students at Harvard bear the brunt of White House ban

BOSTON, Massachusetts: U.S. President Donald Trump's administration has taken away Harvard University's right to enroll international...

God responsible for his presidency, claims Trump

WASHINGTON, DC - U.S. President Donald Trump on Monday said he believed God was behind his election loss in 2020, even though he has...

Passenger traffic plummets at Newark Airport amid travel disruptions

NEW YORK CITY, New York: Passenger numbers at Newark Liberty International Airport in New Jersey have dropped sharply, according to...

EU probes Visa, Mastercard fees amid antitrust scrutiny

BRUSSELS, Belgium: European Union antitrust regulators are examining fees imposed by payment giants Visa and Mastercard, Bloomberg...

US Army to list only birth sex in transgender soldiers' records

WASHINGTON, D.C.: The U.S. Army plans to change the records of transgender soldiers to list only their sex at birth, according to a...

Sydney

SectionRemembering kids that have vanished in Australia over many years

Leela found joy in dancing. Megan loved the freedom of ice skating. Ronya was always singing along to pop songs. Cherie's favourite...

Aussie firms upbeat on China outlook despite trade tensions

SYDNEY, Australia: Australian businesses are feeling optimistic about their prospects in China despite escalating global trade tensions,...

Police seize Sydney pharmacist's assets as part of fraud probe

SYDNEY, Australia - A pharmacist has been charged after allegedly defrauding the Pharmaceutical Benefits Scheme (PBS) of more than...

Australia could tax Google, Facebook and other tech giants with a digital services tax - but don't hold your breath

Tech giants like Google, Facebook and Netflix make billions of dollars from Australian users every year. But most of those profits...

From surprise platypus to wandering cane toads, here's what we found hiding in NSW estuaries

Rivers up and down the north coast of New South Wales have been hammered again, just three years after devastating floods hit the Northern...

James Bradley's thrilling, unsettling crime novel is set in a flooded Sydney in 2050

James Bradley is a brilliant writer of fiction, nonfiction and poetry. His recent book Deep Water (2024) is an elegiac essay in response...