Why robodebt's use of 'income averaging' lacked basic common sense

The Conversation

16 Mar 2023, 12:08 GMT+10

The practice of "income averaging" to calculate debts in the robodebt scheme was completely flawed. This is what I confirmed in my new report conducted for the robodebt royal commission published last Friday, the final day of the commission's public hearings.

This process effectively assumed many people receiving social security benefits had stable earnings throughout a whole year.

But this is unlikely to be accurate for the many people who don't work standard full-time hours, and particularly for students, since the tax year and the academic year don't coincide.

My report finds averaging of incomes is completely inconsistent with social security policies that have been developed by governments since the 1980s.

Since 1980, social security legislation has been amended more than 20 times to encourage recipients to take up part-time and casual work. These include the Working Credit for people receiving unemployment and other payments, and a similar but more generous Income Bank for students.

These measures are specifically designed to encourage people to take up more work, including part-time and irregular casual work, and keep more of their social security payments.

Robodebt's lack of consistency with long-standing policies should have been obvious from the start.

What is income averaging?

In the robodebt scheme, income averaging involved data-matching historic records of social security benefit payments with past income tax returns, identifying discrepancies between these records.

It reduced human investigation of the discrepancies. The automatic calculation of "overpayments" for many people was based on a simple calculation that averaged income over the financial year.

The "debts" were based on the difference between this averaged income and the income that people actually reported while they were receiving payments.

I wrote an article for The Conversation on this in 2017. At the time, I thought, Centrelink couldn't possibly have done that.

Well, as the royal commission has found, that's precisely what it was doing.

Read more: Note to Centrelink: Australian workers' lives have changed

A victim of robodebt, Deanna Amato, brought a test case to the Federal Court in 2019, which caused the government to admit robodebt was unlawful.

Amato also gave evidence at the royal commission in late February this year. She described how it was obvious her debt was in error:

What I found

It's well known Australia has a high proportion of casual workers.

Because they're employed on an "as needed" basis, their hours can vary substantially. Therefore, their income can too.

ABS data showed that in 2014 nearly 40% of casual workers didn't work the same hours each week. Also, around 53% had pay that varied from one pay period to another. These figures have been broadly stable since 2008.

Read more: Robodebt was a fiasco with a cost we have yet to fully appreciate

My report analyses new data provided by the Department of Social Services to the royal commission. It looks in detail at the circumstances of people who received social security payments between 2010-11 and 2018-19. These payments included Austudy, Newstart, Parenting Payment Partnered, Parenting Payment Single and Youth Allowance.

These payments accounted for around 91% of the people subject to the reviews that identified discrepancies and potential "overpayments" between 2016 and 2019 under the different phases of robodebt.

For Newstart and Youth Allowance recipients - who accounted for 75% of those affected by robodebt - between 20% and 40% had earnings while receiving these benefits.

The share of people with income who had stable incomes over the course of the financial year was extremely low. In the Department of Social Services data, it ranged from less than 3% of people receiving youth payments, to around 5% of those receiving Newstart or Austudy, and 5%-10% of those receiving Parenting Payments.

Share of people on social security payments with stable income over the course of each financial year, 2010-11 to 2018-19

For most of these people with variable income, the variations were large. More than 90% had periods when their income was more than $100 per fortnight different from their average, and more than 80% had variations greater than $200 per fortnight.

Average earnings varied substantially for people receiving social security payments for only part of a financial year. Receiving social security benefits for many people is a short-term and sometimes recurring experience.

To take the example of Newstart, in 2015-16 there were around 783,000 people who received payments at the start of the financial year. About 500,000 people entered the payment system during the year, and 325,000 exited the system. So, in total, nearly 1.2 million people received Newstart payments at some point during the financial year. Flows into and out of the other social security payments were similar.

Read more: The Robodebt scheme failed tests of lawfulness, impartiality, integrity and trust

For the unemployed and students, most people received payments for only part of the year. Almost nobody who received income had completely stable income over the robodebt period. What's more, significant numbers of people who received social security payments were on such payments for only part of any financial year.

It's completely inaccurate to assume that income over the course of a financial year can be averaged to produce an accurate figure for the actual patterns of people's earnings.

Using this to then calculate "overpayments" isn't only inconsistent with the social security policy directions adopted by government for decades, it also lacks basic common sense.

Author: Peter Whiteford - Professor, Crawford School of Public Policy, Australian National University

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Australian Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Australian Herald.

More InformationInternational

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Sydney

SectionWestern Sydney raid results in seizure of $25 Million in drugs

SYDNEY, NSW, Australia - , Australian Federal Police (AFP) have shut down a secret drug lab in Sydney's west and seized more than 100kg...

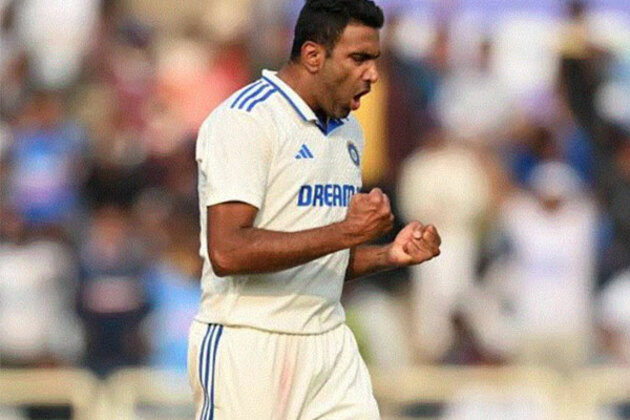

"England will play Bumrah carefully, Bazball everyone else...": Ravichandran Ashwin

New Delhi [India], July 1 (ANI): Former Indian cricketer Ravichandran Ashwin believes England will focus on playing cautiously against...

Ravindra Jadeja's form a concern as India head for second Test against England

Birmingham [UK], July 1 (ANI): As Team India gears up for the second Test in Birmingham against England, there would be worries about...

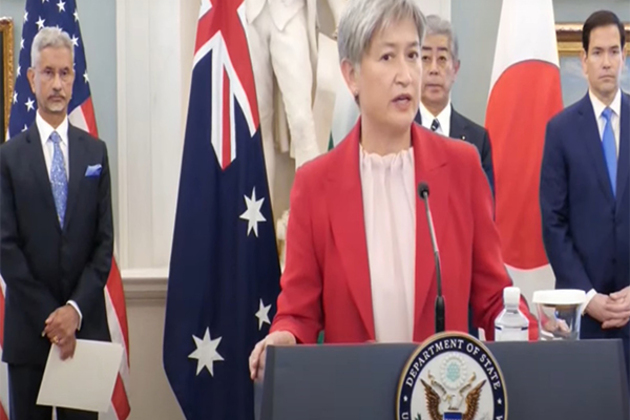

"Future of 21st century" being made, shaped in Indo-Pacific: Australia's FM Wong highlights Quad's significance

Washington DC [US], July 1 (ANI): Australian Foreign Minister Penny Wong on Tuesday highlighted the Quad's significance, stating that...

NMDC expands global footprint with its new office in Dubai, forging global pathways in mining

Hyderabad (Telangana) [India], July 1 (ANI): NMDC, India's largest iron ore producer, marked a significant milestone with the inauguration...

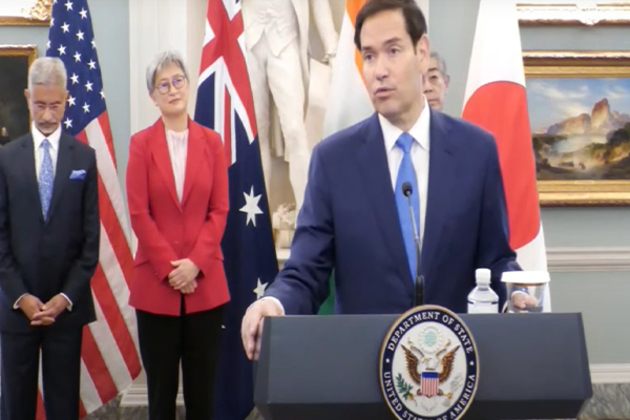

Rubio focuses on diversifying global supply chain of critical minerals at Quad Foreign Ministers meet

Washington, DC [US], July 1 (ANI): US Secretary of State Marco Rubio on Tuesday emphasised the importance of diversifying the global...