Foreign investors sold Rs 15,236 cr in Indian stocks in 2023

ANI

22 Jan 2023, 13:33 GMT+10

New Delhi [India], January 22 (ANI): Foreign portfolio investors (FPIs) have sold assets worth about Rs 15,236 crore in Indian stock markets so far in 2023 (till January 20), the latest data from National Securities Depository showed.

Foreign investors are apparently cautious amid risks of the potential return of Covid, besides looming global recession worries as flagged by various agencies.

In November and December 2022, foreign portfolio investors (FPIs) were net buyers. They had bought assets worth Rs 36,239 crore and Rs 11,119 crore, respectively.

Prior to November, they were net sellers in September and October amid the then-strong US dollar index, weak rupee, and tightening of monetary policy.

Notably, barring some exceptions, foreign portfolio investors (FPIs) had been selling equities in the Indian markets for over a year, which started in October 2021 for various reasons.

In 2022, foreign portfolio investors overall sold Rs 121,439 crore worth of stocks in India on a cumulative basis, the data available on the NSDL website showed.

Tightening monetary policy in advanced economies including rising demand for dollar-denominated commodities, and strength in the US dollar had triggered a consistent outflow of funds from Indian markets. Investors typically prefer stable markets in times of high market uncertainty.

Meanwhile, a World Bank report has projected that the global economy will grow by a mere 1.7 per cent in 2023, down from the 3 per cent it estimated in its earlier forecast. In 2024, the global economy is projected to grow by 2.7 per cent, against the previous estimate of 3 per cent.

Given fragile economic conditions, any new adverse development such as higher-than-expected inflation, an abrupt rise in key interest rates to contain it, a resurgence of the Covid-19 cases, or escalating geopolitical tensions could push the global economy into recession, the World Bank report said. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Australian Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Australian Herald.

More InformationInternational

SectionMississippi and Kentucky move toward ending income tax

FRANKFORT/JACKSON: It is been about 45 years since a U.S. state last got rid of its income tax on wages and salaries. But now, Mississippi...

Electric utilities feel the heat as AI needs soar

NEW YORK CITY, New York: As artificial intelligence drives soaring demand for data processing, electric utilities across the United...

Deadly storms flood Kentucky, pose threat to lives, homes

FRANKFORT, Kentucky: Heavy rain over several days caused rivers to overflow across Kentucky, flooding homes and threatening a famous...

Ukraine, US resume talks on critical minerals deal

KYIV, Ukraine: Talks between Ukraine and the United States over a critical minerals agreement are set to continue this week, as officials...

SpaceX, ULA, Blue Origin win $13.5 billion in space force contracts

WASHINGTON, D.C.: Elon Musk's SpaceX, Jeff Bezos' Blue Origin, and United Launch Alliance (ULA) won U.S. military contracts worth US$13.5...

IRS begins major layoffs, civil rights office hit first

WASHINGTON, D.C.: The U.S. Internal Revenue Service (IRS) began laying off workers late last week, according to an email sent to staff,...

Sydney

SectionAUSTRALIA-CANBERRA-EXHIBITION-ABORIGINAL AND CHINESE PEOPLE

(250410) -- CANBERRA, April 10, 2025 (Xinhua) -- A piece of exhibit is seen at the exhibition Our Story: Aboriginal Chinese People...

Australia donates drones to strengthen Philippines maritime security amid South China sea tensions

Manila [Philippines], April 10 (ANI): Australia's contribution of 20 advanced drones to the Philippines underscored Manila's urgent...

South Africa captain Temba Bavuma sustains elbow injury two months before WTC final

Johannesburg [South Africa], April 10 (ANI): South Africa Test captain Temba Bavuma has suffered an elbow injury, which has prevented...

Indian women's hockey team set to tour Australia for five-match series

New Delhi [India], April 10 (ANI): The Indian women's hockey team is all set to embark on an exciting tour of Australia for a five-match...

Cricket can make you cry, look at Prithvi Shaw: Basit Ali warns Jaiswal amid lost form in IPL

Islamabad [Pakistan], April 10 (ANI): Former Pakistan cricketer Basit Ali sent a bold message to out-of-form Yashasvi Jaiswal to bring...

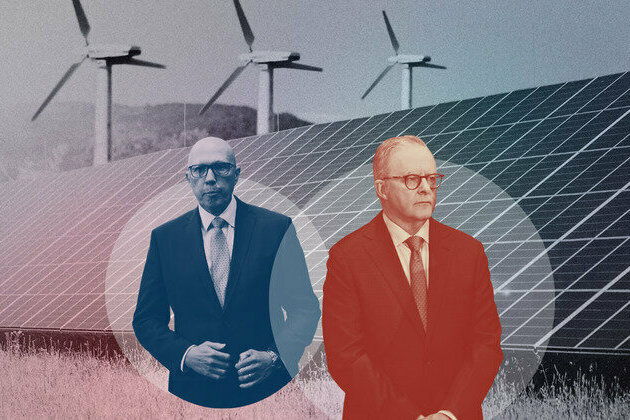

Australia urgently needs to get serious about long-term climate policy - but there's no sign of that in the election campaign

The federal election should be an earnest contest over the fundamentals of Australia's climate and energy policies. Strong global...