Emergency loans from financial bodies not to solve Pakistan's woes, need to diversify its economic policies

ANI

23 Sep 2022, 19:25 GMT+10

Islamabad [Pakistan], September 23 (ANI): Pakistan needs an overhaul of economic policy as the country is facing its worst ever floods in history accompanied by a huge resource gap despite getting emergency loans from global financial bodies for the reconstruction.

The pressure of the resource gap is mounting as Pakistan is unable to seek foreign aid or loans due to its non-performing economy with slow growth, twin deficits, shrinking foreign exchange and uncontrolled inflation, reported Financial post.

Due to poor macroeconomic indicators, its sovereign credit rating has slipped to non-investment grade. Citing Pakistan's weakening economic condition, Moody's, Fitch, and SP Global - all major global rating agencies - downgraded Pakistan's long-term rating from stable to negative in July. These agencies had also highlighted the country's weakening external position, higher commodity prices, rupee depreciation and tighter global market conditions.

It is evident from the recent disclosure of Finance Minister Miftah Ismail stating that "none of the friendly countries is ready to financially support Pakistan" because it "has an imbalanced economy".

Recently, Pakistan got restored the IMF's Extended Fund Facility (EFF) and the World Bank's intent of clubbing two of its policy loans over USD 1 billion and the Asian Development Bank's (ADB) indication to provide approximately USD 1.5 billion emergency loans.

The problem has in fact prompted the Pak Government to levy an unpopular super tax with three rates Rs 3000/-, Rs 5000/- and Rs 10,000/- to collect Rs 41 billion tax from shopkeepers and an additional tax of 5 per cent on manufacturers having zero contribution to exports, reported Financial Post, reported Financial Post.

The decision of the IMF to extend EFF to the end-June 2023 and re-phasing and augmentation bringing the EFF to USD 6.5 billion would give only temporary relief. The 7th and 8th tranches would release about USD 1.17 billion under EFF for Pakistan.

Islamabad is experiencing huge differences between imports and exports. And despite recent measures taken to ban the import of various items, Pak imports continue to rise.

While policymakers in Islamabad are firefighting to manage the economy in the aftermath of catastrophic floods, the funds arranged by the IMF to avert a default in foreign debt are also causing a lot of pressure on the economy due to stringent conditionality on the country which has seen very fragile growth during COVID-19 period and accumulated unsustainable debt and current account deficit over time, reported Financial Post.

Moreover, the IMF conditionality includes hiking power tariffs, imposing a levy on petroleum, higher revenue mobilization and restraining expenditure to reduce the fiscal deficit, continued adherence to market-determined exchange rate and setting up an anti-corruption task force to curb graft in government departments.

Further, Pakistan is unable to boost its exports to overcome its ever-belonging trade deficit. Due to a lack of diversification and value addition, many industries could not contribute to the country's export basket but kept on importing raw materials to cater to internal markets, reported Financial Post.

For increasing exports, Pakistan needs to focus on its comparative advantage and collaboration with foreign companies which could help industrial growth through technology transfer as well as providing capital for industrialization. Just relying on China has not helped much and would not do well even in future.

Pakistan is also facing other pressures. The Power Purchasing Agreements (PPA) of the China-Pakistan Economic Corridor (CPEC) is a contentious issue between Pakistan, China and the IMF and the main condition is to "reduce circular debt flow through reducing power generation costs and retargeting electricity subsidies".

Pakistan cannot achieve macroeconomic stability until its power sector is fixed. The IMF has also flagged the abrupt growth slowdown in China as a major concern as its financial elbow room leverage, a key strategic partner, is shrinking, reported Financial Post. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Australian Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Australian Herald.

More InformationInternational

SectionHistoric ISS mission launches with crew from 4 different nations

CAPE CANAVERAL, Florida: In a landmark flight for three nations and a veteran U.S. spacefarer, a four-member astronaut crew launched...

U.S. government sues Maryland court over pause in migrant deportations

WASHINGTON, D.C.: In a striking escalation of tensions between the executive and judicial branches, the Trump administration has filed...

Thailand-Cambodia tensions rise as border rules tighten

BANGKOK, Thailand: This week, Thailand implemented land border restrictions, including a ban on tourists traveling to Cambodia, as...

Alliance eyes major military buildup to counter Russia

THE HAGUE, Netherlands: NATO is pressing ahead with a sweeping new defense spending target, calling on all 32 member nations to commit...

Mamdani leads NYC mayoral race in stunning upset over Cuomo

NEW YORK, U.S.: A political newcomer is on the verge of reshaping New York City politics. Zohran Mamdani, a 33-year-old state assemblyman...

Millions endure dangerous US temperatures, heat alert issued

MADISON, Wisconsin: Tens of millions of residents across the Midwest and East Coast faced dangerously high temperatures over the weekend...

Sydney

SectionAbhishek Nayar reveals Rohit wanted him to work with KL Rahul to bring best out of him

New Delhi [India], June 28 (ANI): Former India assistant coach Abhishek Nayar revealed that ODI captain Rohit Sharma wanted him to...

WI captain Roston Chase calls out "questionable calls" in " frustrating" opening Test against Australia

Bridgetown [Barbados], June 28 (ANI): West Indies captain Roston Chase launched a scathing tirade and doubled down on the criticism...

Australia's Steve Smith takes step closer to return, had "few hits" in New York, confirms skipper Cummins

Bridgetown [Barbados], June 28 (ANI): Australia's batting mainstay Steve Smith is set to rejoin the squad in Barbados and had a crack...

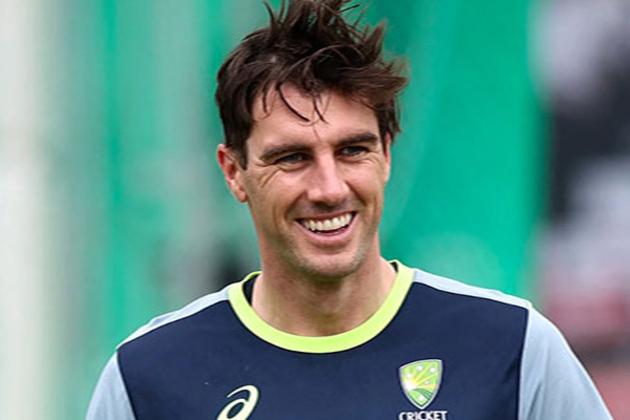

Cummins picks Australia's "special" player after wrapping up "great" Test against WI with victory

Bridgetown [Barbados], June 28 (ANI): Australia captain Pat Cummins was all in praise of 'special' Josh Hazlewood, who ripped through...

Scientists develop sustainable gold extraction from electronic waste

CANBERRA, June 28 (Xinhua) -- Australian scientists have developed a more sustainable method to extract gold from both ore and electronic...

Katy Perry shares her "mood" in first post after her split from Orlando Bloom

Washington DC [US], June 28 (ANI): Katy Perry and Orlando Bloom have called off their relationship. American singer-songwriter has...