Asset quality headwinds to impact retail NBFC net earnings

ANI

17 Apr 2021, 17:25 GMT+10

New Delhi [India], April 17 (ANI): The growth in assets under management (AUMs) of retail non-banking financial company (retail NBFC) sector is expected to revive in FY22 to about 8 to 10 per cent as compared to an estimated growth of a muted 3 to 5 per cent in FY2021, according to investment information agency ICRA.

The AUM growth, however, is expected to be slower than past trends when it grew at a compound annual growth rate (CAGR) of 18 per cent between March 2016 to March 2020.

"Localised lockdowns in view of the recent surge in Covid-19 infection rates can impact a sustainable revival and will remain a near-term monitorable," said ICRA.

Asset quality issues visible in Q3 FY21 are expected to remain elevated in Q4 FY21 and play out fully in FY22.

ICRA expects incremental slippages to keep non-performing assets (NPAs)/gross stage 3 assets at elevated levels even in FY22 after an increase in FY21 as the level of economic activities are yet to substantially pick up over the pre-Covid levels.

The increase is expected to be about by about 50 to 100 bps (over December 2020 levels) by March 2022 as a base case and could inch-up further if the impact of the impact of the pandemic continues for longer period leading to lockdowns or other tighter restrictions.

ICRA said restructuring has been lower than expected. However, loan losses and write offs have increased in Q3FY21. Entities nevertheless continue to maintain higher provisions (about 50 per cent higher than pre-Covid levels), which presently is a buffer.

The increase in infection rates in recent past and localised lockdowns/restrictions in a few states have increased near-term uncertainties. Thus entities may carry higher provisions at least over the next few quarters and credit cost is expected to remain elevated.

The profitability indicators were impacted in FY21 as provision and credit costs increased sharply due to the expected portfolio stress and will remain at similar levels even in FY22.

ICRA said the expectation of high incremental slippages and slower growth versus past trends even in FY22 will keep the profitability 30 per cent below the pre-Covid levels. The capital structure is expected to remain adequate.

While some entities raised fresh equity in FY21, ICRA said that moderate growth expectations even in FY22 notwithstanding the reduction in internal generation because of weakening in earnings performance will not necessitate any significant fresh capital raise in the near term. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Australian Herald news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Australian Herald.

More InformationInternational

SectionTrump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Sydney

SectionWestern Sydney raid results in seizure of $25 Million in drugs

SYDNEY, NSW, Australia - , Australian Federal Police (AFP) have shut down a secret drug lab in Sydney's west and seized more than 100kg...

What's next for NSW's intense storm? Heavy rains, fallen trees -and a chance of a storm 'slingshot'

Millions of people in New South Wales hunkered down last night as an intense bomb cyclone swept in. Falling trees took out power lines,...

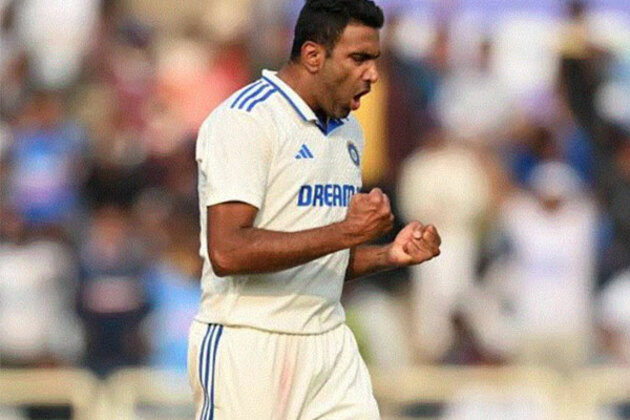

"England will play Bumrah carefully, Bazball everyone else...": Ravichandran Ashwin

New Delhi [India], July 1 (ANI): Former Indian cricketer Ravichandran Ashwin believes England will focus on playing cautiously against...

Ravindra Jadeja's form a concern as India head for second Test against England

Birmingham [UK], July 1 (ANI): As Team India gears up for the second Test in Birmingham against England, there would be worries about...

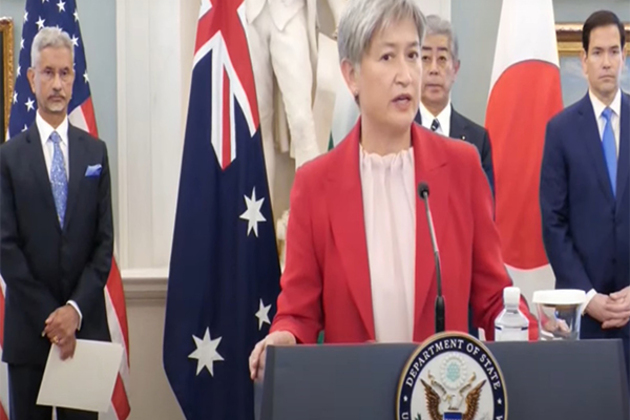

"Future of 21st century" being made, shaped in Indo-Pacific: Australia's FM Wong highlights Quad's significance

Washington DC [US], July 1 (ANI): Australian Foreign Minister Penny Wong on Tuesday highlighted the Quad's significance, stating that...

NMDC expands global footprint with its new office in Dubai, forging global pathways in mining

Hyderabad (Telangana) [India], July 1 (ANI): NMDC, India's largest iron ore producer, marked a significant milestone with the inauguration...